Beware, the robots are taking over… monotonous and repetitive tasks. Find out what intelligent automation is, and the power it holds within the Financial Services industry.

Demystifying intelligent automation

Intelligent automation leverages the power of artificial intelligence (AI) and automation to complete a variety of tasks that would have formerly been performed manually. By combining the power of machine learning, natural language processing and robotic process automation (RPA), intelligent automation allows organisations to automate repetitive, rule-based processes to improve operational efficiency.

In the realm of Financial Services, organisations are under immense pressure to reduce costs, comply with strict regulations and deliver exceptional customer experiences. Crucially, intelligent automation offers the following benefits:

Enhanced efficiency

Automating manual, repetitive and time-consuming tasks frees up employee time to focus on value-add activities. AI and intelligent automation combined can offer enhanced customer service and support to reduce the burden on human agents. This is carried out by AI-powered chatbots and virtual assistants to handle customer enquiries, provide personalised recommendations and resolve common issues.

Improved accuracy

Intelligent automation minimises human error and as such, the risk of expensive mistakes. Operating with enhanced data accuracy, intelligent automation ensures compliance with regulatory requirements in the Financial Services industry.

Streamlined processes

Say goodbye to process bottlenecks as end-to-end processes are automated and disparate systems are integrated. Intelligent automation drives smoother operations, quicker turnaround times and as a result, increased customer satisfaction.

How do these benefits translate in the Financial Services industry?

Banking

Intelligent automation simplifies customer onboarding, loan processing and fraud detection by automating data collection, validation and analysis. Banks can accelerate decision-making, mitigate risks and deliver more personalised customer experiences – according to Gartner, 71% of customers now expect companies to be well informed about their personal information during a customer service interaction. By using AI with intelligent automation, customer data and behaviours can be analysed to offer personalised product recommendations, tailored financial advice and customised offers.

AI algorithms paired with intelligent automation can analyse vast amounts of transactional data in real time, identifying patterns that indicate fraudulent activities, as well as aiding in Know Your Customer (KYC) processes.

Incremental has extensive experience in working with leading UK bank, Virgin Money, helping to digitise its customer onboarding process using the Microsoft Power Platform. This increased customer acquisition rates by 580% – read our case study to learn more.

Capital markets

In this sector, timely and accurate data analysis is crucial due to market volatility and complexity. Intelligent automation can automate data gathering from multiple sources using AI and machine learning, saving hours of work. AI-powered algorithms can track market trends, historical data and news events to optimise investment strategies and manage portfolios dynamically. On top of this, AI and intelligent automation offer enhanced regulatory reporting and streamline customer due diligence processes to support compliance activities.

Insurance

Insurers can reap the benefits of claims processing, automated underwriting (check out our Underwriter Workbench) and policy administration tasks like policy issuance, renewals and endorsements through intelligent automation. This leads to increased operational efficiency and reduced manual errors.

Amplify intelligent automation, by leveraging RPA within Power Automate

Robotic process automation (RPA) within Microsoft’s Power Automate is a truly transformational automation tool, well suited to Financial Services organisations.

Power Automate empowers users within Financial Services (non-technical users as well as developers) to easily build automation into the applications that they use every day, thus optimising and speeding up a wide range of business tasks. Within Power Automate, RPA utilises software robots to replicate human interactions with applications and systems. In Financial Services, RPA is a game-changer in processes like customer data validation, reconciliation of transactions and report generation.

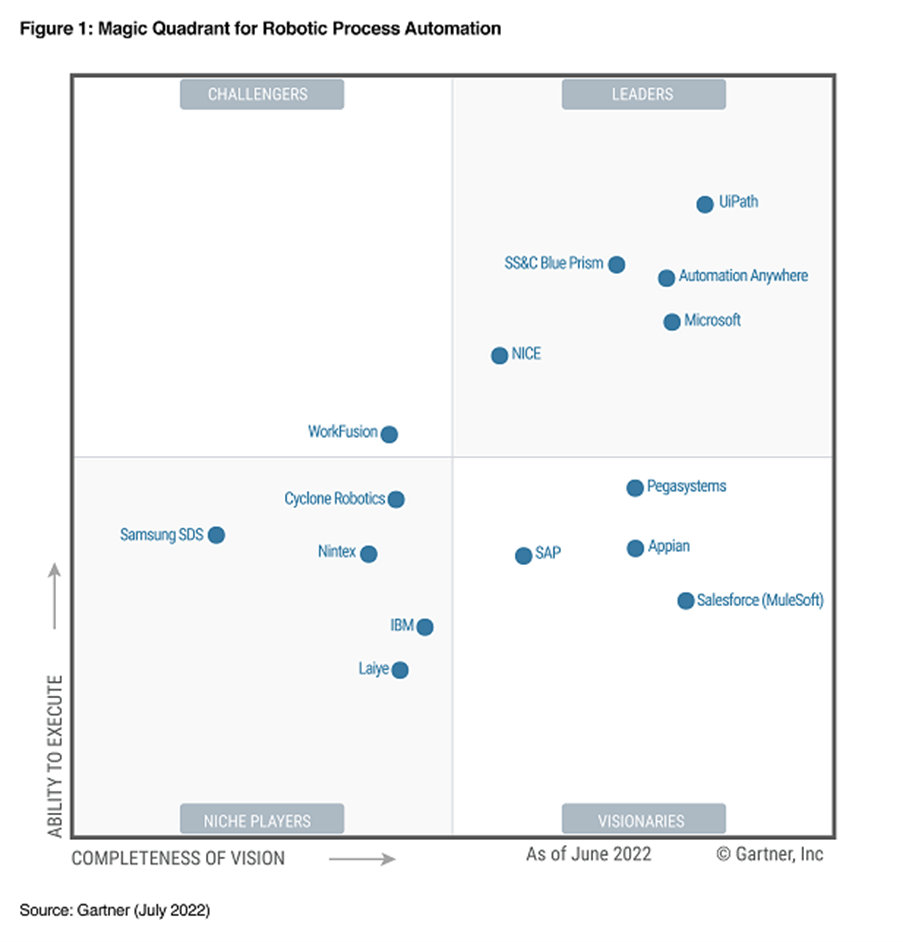

Microsoft was also named as a leader in Gartner‘s Magic Quadrant for RPA for the second year in a row:

Above: 2022 Gartner Magic Quadrant for Robotic Process Automation (RPA)

Power Automate’s intuitive interface enables business users to create and manage automated workflows, while RPA tackles complex, rule-based processes that require interaction with multiple systems. These technologies combined enable Financial Service organisations to unlock new levels of efficiency, accuracy and agility without compromising on security.

Do more, with less

Intelligent automation using Microsoft Power Automate and RPA allows Financial Services organisations to leave back-end, repetitive tasks to the robots, and dedicate precious time to what’s valuable. Discover more about how intelligent automation can help your organisation to do more with less by getting in touch with our team of Financial Services experts today.