Discover the ways the Microsoft Power Platform and Robotic Process Automation (RPA) can relieve some of the growing productivity, financial and competitive pressures faced by Financial Services organisations.

In today’s challenging landscape, banks and wealth management firms are under immense pressure to reduce costs, increase efficiency and remain competitive. To support these pressures, the Microsoft Power Platform and Robotic Process Automation (RPA) tools are powerful solutions that can help organisations streamline operations, improve employee productivity and drive down internal costs.

The Microsoft Power Platform is a suite of low-code tools that allow users to create custom business applications, automate workflows and analyse data. The tools in the Power Platform can be used to create custom solutions for a variety of use cases, from simple data entry forms to complex financial models.

RPA is a software technology that automates repetitive, rule-based tasks, freeing up employees to focus on higher-value activities. RPA processes can be programmed to perform a wide range of tasks, from data entry to report generation, and can be integrated with other tools to create seamless workflows.

Here are 5 reasons why Telefónica Tech believes banks and wealth management firms should consider using the Microsoft Power Platform and RPA tools:

1 – Reduction in manual work

One of the biggest benefits of RPA is that it can automate repetitive tasks, such as data entry and report generation. These repetitive tasks are completed daily by many employees across an organisation from Sales, Marketing and the Front Office through to Finance, Operations and the Back Office. By automating these tasks, firms can reduce the amount of time these employees spend on manual work, freeing them up to focus on more strategic and complex activities.

2 – Streamline workflows and processes

The Microsoft Power Platform and RPA tools can help organisations streamline their workflows and processes, reducing the time it takes to complete tasks manually by an employee. This can help firms increase their efficiency, reduce errors and improve customer service and experience.

3 – Improving compliance

Banks and wealth management firms operate in a highly regulated industry and are subject to strict compliance requirements. The Microsoft Power Platform and RPA tools can help these organisations ensure that their processes are compliant with regulations, reducing the risk of fines and penalties and removing manual intervention where appropriate.

4 – Enhancing customer experience

By automating repetitive tasks and streamlining workflows, firms can improve their customer service and experience. This accelerated rate of problem resolution and increased time to dedicate to providing an improved standard of service can lead to higher customer satisfaction rates and increased customer loyalty.

5 – Reducing costs

By automating tasks and streamlining workflows, firms can reduce internal costs. This can help these organisations remain competitive in a fast-evolving digital environment and invest in new technologies and services.

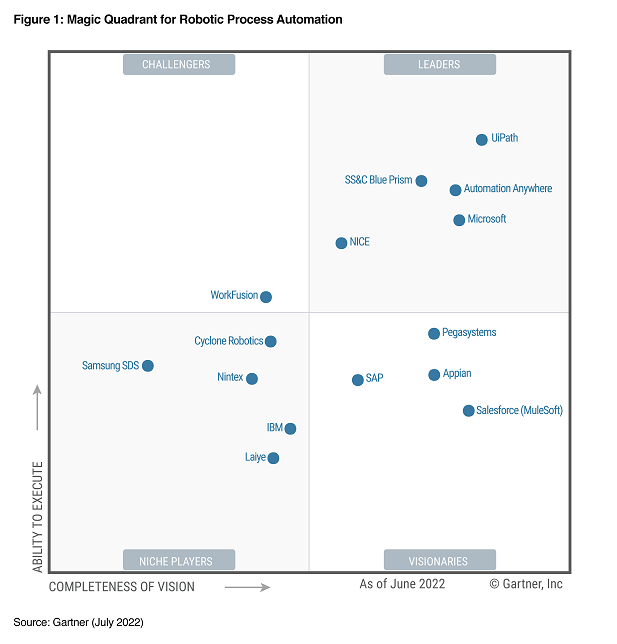

Microsoft was also named as a leader in Gartner‘s Magic Quadrant for RPA for the second year in a row:

Above: 2022 Gartner Magic Quadrant for Robotic Process Automation (RPA)

How is Telefónica Tech helping banking and wealth management firms through RPA and the Power Platform?

Automation of customer onboarding processes including:

- Processes covering full organisational websites to back office legacy platform journeys

- Processes to support digital signatures

- Processes covering financial crime / Money Laundering Report Officer (MRLO) procedures.

Automation of customer contact centre processes such as:

- Automated handling of customer complaints

- Card disputes under agreed threshold requests

- Account (cards and savings) closure requests

- Payment date change requests.

Automation of general organisational operations such as:

- New start and leaver processes

- Operation data distribution

- Refresh and distribution of fixed income and factsheet data

- Expenses and travel requests.

Automation of internal service desk processes such as:

- Employee password reset requests

- New equipment requests

- New account requests.

Automation of compliance processes such as:

- Fraud monitoring dashboard tool

- Suspicious activity reporting.

Microsoft Power Platform and RPA tools offer significant benefits to banks and wealth management firms: increased efficiency, improved compliance, enhanced customer experience and reduced costs. By leveraging these tools, organisations can automate their processes, streamline their workflows and focus on delivering value to their customers.

Get in touch with our team of experts today

Telefónica Tech is a Microsoft Partner, a member of Microsoft’s Inner Circle, and won Financial Technology Partner of the Year 2022. Get in touch today to understand how Telefónica Tech can assist your organisation to identify and implement Microsoft Power Platform and RPA, supporting your efficiency, productivity and cost reduction goals.