Digital technologies for finance leaders

To thrive in today’s business environment, in a world with growing complexity, organisations are increasingly relying upon the strategic expertise of their financial leaders. Today’s finance professionals must navigate a range of new challenges and responsibilities – reporting on the past, managing the present, and creating the future.

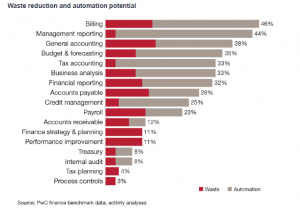

According to a recent report by PwC, Finance Effectiveness Benchmark Report, much of the time spent on finance tasks could be replaced by robotics and automation. Looking at the top four process areas where finance teams spend their time (billing, management reporting, general accounting, and budgeting and forecasting) between 35% and 46% of time and cost could be eliminated by automation and the adoption of more effective, lean working techniques.

Properly applied, technology frees up more time for finance leaders to deliver value. ERP platforms, like Microsoft Dynamics 365 Finance, make it possible to streamline processes and serve as a single source of truth. Data visualisation tools, like Power BI, enable analysis and self-service reporting by business users, making it possible to frame challenges and opportunities in productive new ways. The below three areas of digitisation help new finance leaders to showcase their forward-thinking leadership and get ahead in today’s financial eco-system.

Get a single source of the truth with an ERP system

The journey to being a truly digital finance organisation begins with an intelligent ERP platform. Cloud-based ERP solutions provide the transparency and control needed to respond immediately to potential risks and opportunities. Implementing an ERP system, such as Dynamics 365 Finance, delivers measurable business value and makes a significant positive impact on your organisation.

For finance leaders looking to provide digital transformation across their organisation, Dynamics 365 Finance gives you the tools to accelerate the speed of doing business by empowering people to make smarter decisions, transform business processes faster and drive rapid business growth.

Create value with analytics and data visualisation

To make data-driven decisions, finance teams need real-time financial information. Finance teams often lack access to crucial data because stores of data are in different parts of an organisation, data formats are not comparable, or the data is not available at all. Visual dashboards, such as those produced through Power BI, enable finance leaders and their teams to visualise the data they need when they need it and in the format required.

Predict the future with artificial intelligence

Machine learning (ML) is a type of artificial intelligence (AI) where computers leverage new information to improve their outputs automatically. The power of these intelligent computers, which are frequently cloud-based, is in their ability to process a large volume of information at a speed which humans are not capable of achieving. AI is particularly useful in performing four categories of tasks: detection, classification, probability and optimisation. The in-built AI functionality in Dynamics 365 Finance, helps finance leaders analyse large amounts of data and detect anomalies. This can be used to help identify fraud by monitoring behavioural patterns, flag when a payment will arrive late or detect changes to market conditions. AI can also be used to help mitigate risk by ensuring regulatory compliance and improving operations, flagging abnormal changes or anomalies for further investigation.

Digitisation enables the finance function to automate processes and free up finance roles to focus on more value-added, impactful tasks, and digitisation is now a realistic goal for the finance function, because of a range of technological advances.