If you’re exploring solutions for claims management, you might have come across Microsoft’s suite of business applications and wondered, “Could this work for my organisation?”

Alternatively, you may already be heavily invested in the Microsoft ecosystem and are interested in bringing all your contact, policy, and claims data into one system to create a comprehensive 360-degree customer view.

Microsoft Power Platform is an incredibly flexible set of applications which open up a world of opportunity. So, in this blog, we’ll explore how Power Platform can support your insurance claims management needs and the value it can bring to your business.

What is Microsoft Power Platform?

Microsoft Power Platform is a suite of low-code and no-code tools designed to empower businesses to create and customise applications, automate workflows, analyse data, and build virtual agents without the need for extensive development expertise. The platform consists of several key components:

- Power Apps: Create data-driven applications tailored to your business needs, whether through model-driven or canvas apps.

- Power Automate: Automate complex processes and connect to external applications with ease, reducing the need for manual intervention.

- Power BI: Deliver real-time, advanced reporting and analytics with interactive dashboards.

- Power Pages: Build customer-facing portals that allow policyholders to access claims information, upload documents, and communicate with your team.

- AI Builder: Integrate AI capabilities into your processes, such as document scanning and sentiment analysis.

- Copilot Studio: Develop intelligent chatbots and voice assistants to improve customer service and self-service options.

Together, these tools create a powerful ecosystem for digitising and optimising your insurance business, including insurance claims management.

How Can Power Platform Help with Claims Management?

Insurance claims management is a critical process requiring efficiency, accuracy, and transparency to meet customer expectations and regulatory requirements. Power Platform addresses these needs through its robust capabilities. Here’s how:

1. Streamlining Claims Processing

Claims often involve multiple steps, approvals, and communications. With Power Automate, you can design automated workflows to manage claims from initial notification to resolution. For instance:

- Automate claims approval processes to reduce manual handling and speed up resolution times.

- Set triggers for escalations or additional reviews when specific criteria are met.

- Use business process flows in Power Apps to guide claim handlers through standardised procedures, minimising errors and ensuring compliance.

By reducing manual intervention and creating consistent processes, Power Platform helps enhance operational efficiency.

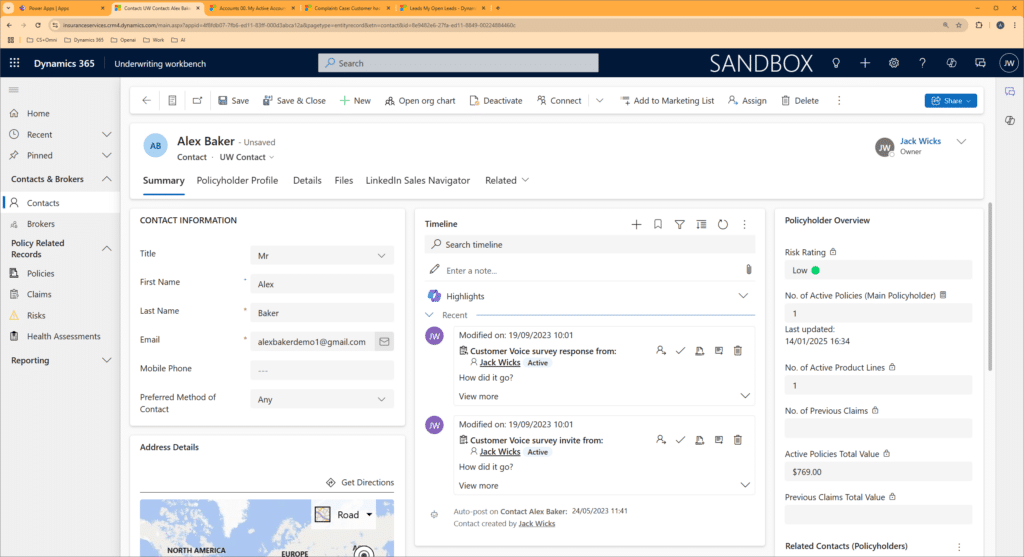

2. Providing a 360-Degree Customer View

Integrating Power Platform with Microsoft Dynamics 365 unlocks the ability to connect claims data with policyholder and contact information. This integration enables:

- A single source of truth for all customer-related data, including policy details, communication history, and claims records.

- Improved decision-making by providing claim handlers with all relevant information at their fingertips.

- Enhanced customer service through personalised interactions and timely updates.

By consolidating this information within Microsoft Dataverse, you empower your team to deliver exceptional service while maintaining full visibility into your customer’s journey.

3. Enforcing Business and Regulatory Processes

Insurance is a highly regulated industry, and non-compliance can lead to significant penalties. Power Platform helps enforce compliance by:

- Standardising claims workflows with business process flows in Power Apps.

- Automating checks to ensure claims meet regulatory standards before approval.

- Providing an audit trail of actions and decisions for each claim.

This ensures that every claim follows the correct procedure, reducing risks associated with non-compliance.

4. Delivering Actionable Data Insights

Power BI transforms your claims data into meaningful insights through visually rich, real-time dashboards. You can monitor key performance indicators (KPIs) like:

- Claims processing times

- Settlement ratios and costs

- Customer satisfaction metrics

These insights enable proactive decision-making and continuous process improvement, ensuring your claims operations remain efficient and customer focused.

5. Seamless Integration with Dynamics 365

If your organisation is already using Microsoft Dynamics 365 for policy or contact management, integrating claims management becomes even more powerful.

By using the same underlying Dataverse, claims data is naturally connected to existing records. This provides:

- Full visibility into customer interactions, policies, and claims in a single system

- Easier tracking of active and resolved claims with complete communication records

- Streamlined processes for both claim handlers and customers

This seamless integration supports a unified approach to managing your insurance operations and drives collaboration across teams.

Why Choose Power Platform for Insurance Claims Management?

In addition to its technical capabilities, Power Platform offers several strategic advantages:

- Scalability: Whether you’re a small insurer or a large enterprise, the platform scales to meet your needs.

- Flexibility: Customise workflows, applications, and integrations to align with your unique business requirements.

- Cost Efficiency: By using low-code tools, you reduce the need for expensive development resources, saving time and money.

- Innovation: Regular updates and new features from Microsoft ensure your claims management system remains up to date with the latest tools, including plenty of AI.

Microsoft Power Platform is more than just a set of tools—it’s a comprehensive ecosystem designed to transform how you manage insurance claims. By automating workflows, enforcing compliance, and providing actionable insights, it helps insurers deliver faster, more accurate, and customer-centric claims services.

If you’re ready to modernise your claims management process and explore the benefits of Power Platform, get in touch today to learn how we can tailor a solution that fits your organisation’s needs and goals.