Legacy, on-premises ERP solutions can result in a number of challenges for organisations, such as high maintenance costs, absence of real-time visibility and overreliance on manual processes and passed-down knowledge. That’s why Dynamics 365 Finance is the go-to cloud-based ERP solution for organisations that want to remain competitive.

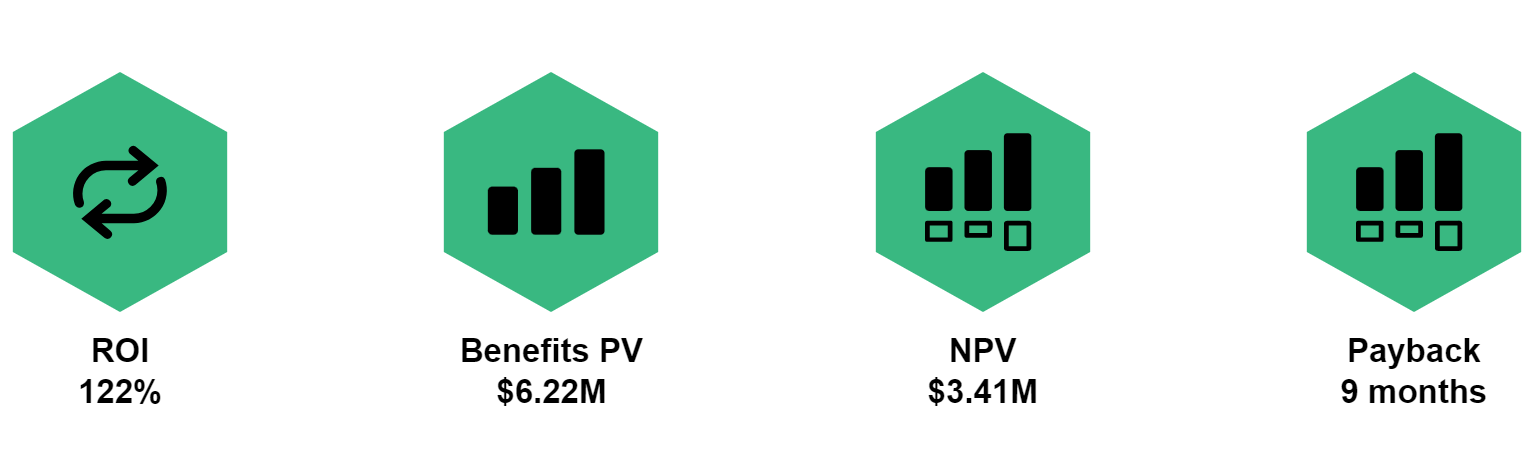

If you were looking for a reason to migrate to Dynamics 365 Finance, then look no further. Commissioned by Microsoft, Forrester Consulting conducted a Total Economic Impact (TEI) assessment to consider the potential ROI for organisations adopting Dynamics 365 Finance and uncovered several other benefits along the way. With a potential ROI of 122%, here are some of the other key benefits of migrating to Dynamics 365 Finance according to the Forrester Study…

Improve finance staff productivity by up to 55%

Legacy ERP products used before the deployment of Dynamics 365 Finance slowed down processes due to manual report creation and distribution, meaning more staff (sometimes external hires) were needed for these tasks. Following the implementation of Dynamics 365 Finance, these financial processes are standardised and streamlined, reducing the need for external hires and allowing staff to spend time on activities that create business value. Through this standardisation, regional constraints are eliminated and real-time information is available for key business decisions, as well as improved employee satisfaction through the eradication of monotonous tasks – improving retention rates. This change saved the composite organisation that the Forrester study used around £2 million.

Save on legacy costs

In migrating to Dynamics 365 Finance cloud-based ERP system, automatic updates mean that organisations can save millions in costly infrastructure refreshes, decommissioning out-of-date solutions and cutting external support costs. Furthermore, organisations can prevent overspending on infrastructure, since Dynamics 365 Finance allows for real-time scaling; helping businesses keep up with dynamic market conditions without any unnecessary costs. The study’s composite organisation equated to almost £3 million in legacy cost savings over a three-year period.

Dynamics AX is a legacy system that pre-dates Dynamics 365: click here to learn more about the decommissioning and migration process.

IT staff productivity increase

Outdated legacy products create a multitude of challenges for IT productivity: on-premises ERP solutions are highly customised and require a lot of time and investment to update and maintain. Often, the IT team members with expert knowledge of the legacy system and its customisations move elsewhere, resulting in further customisations becoming more time-consuming for IT teams. In standardising ERP processes through Dynamics 365 Finance’s easily supported solution with fewer customisations required, costs are saved in IT administrator and developer hours.

Better flexibility

Real-time decision-making can be better enabled through the availability of real-time data, rather than static data which could become out-of-date by the time it reaches key decision markers. From utilising the most up-to-date data to inform financial decisions, organisational flexibility is enhanced, driving accelerated business performance and organisational agility.

Additional benefits of migrating to Dynamics 365 Finance include:

- Improved system availability: Dynamics 365 Finance is far less likely to face disruptions due to being cloud-based.

- Improved regulatory compliance: simplified regulatory processes on Dynamics 365 Finance save staff personal hours and external costs.

- Integration with other Microsoft solutions such as Power Apps, Power BI and Windows.

The findings of the Forrester study are clear – why wait to migrate? Telefónica Tech has extensive experience and expertise in successfully implementing and supporting the Microsoft Dynamics range – get in touch today to find out how Dynamics 365 Finance can significantly save costs for your organisation.