During Ignite, Microsoft shared insight to new functionality being introduced to Dynamics 365 Finance, including the new asset leasing module.

With social distancing and lockdown restrictions becoming the new norm, this year’s Microsoft Ignite conference was for the first time a fully online event. Through a series of virtual sessions Microsoft showcased its latest product developments and solution updates. For Dynamics 365 Finance users, the new functionality gained from the asset leasing module is worth diving into.

Asset leasing module – overview

The introduction of asset leasing from November 2020 will enable organisations to manage their lease accounting processes whilst ensuring compliance and adherence with the new lease accounting standards under Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) 842 and International Financial Reporting Standards (IFRS) 16.

The objective of both new lease accounting standards is to enhance financial transparency by requiring the following:

- Leases are to be reported on lessee’s balance sheet as assets and liabilities

- The creation of a right-of-use asset for most lessee contracts.

For more information on the reporting differences between the two accounting standards, you can refer to this helpful KPMG guide.

The new asset leasing module will support compliance with these regulations whilst reducing the risk of manual errors and time spent by users to create the necessary reports through automatic updates and calculations.

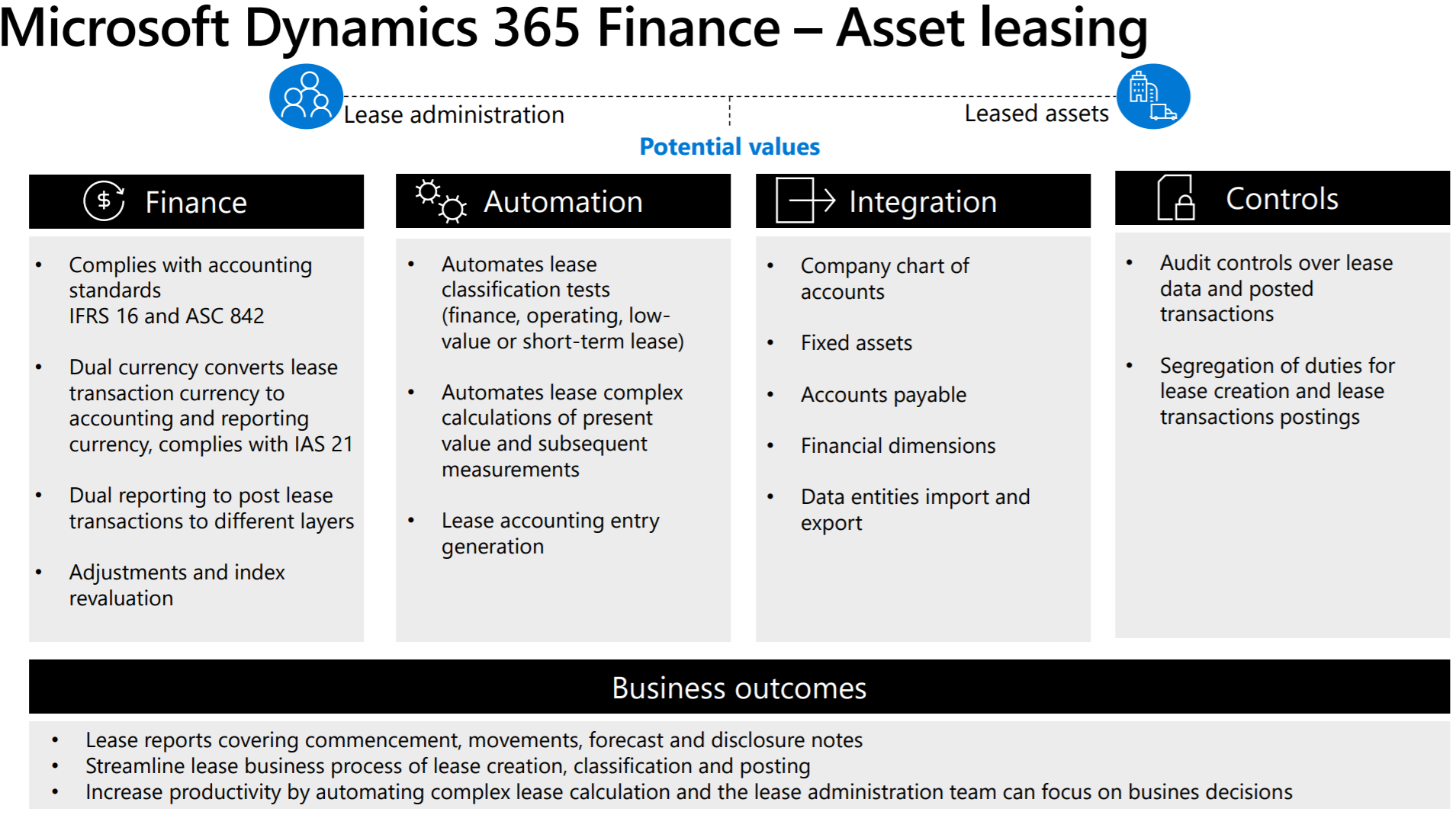

The features of the new asset leasing module can largely be grouped in five key areas: finance, automation, integration, controls and business outcomes. Here are the key functional benefits for each of these areas.

Finance

- The new asset leasing module enables a means of centralising the management of lease information, such as important dates, including the commencement and expiration dates, as well as the lease’s transaction currency, payment amounts and payment frequency.

- The module complies with the accounting standards to represent leases on a balance sheet using the balance sheet impact calculator.

Automation

- The automation of complex lease calculations through the classification of the lease as either operating or financial, short-term or low-value lease. This supports reporting through the balance sheet or profit and loss as determined by accounting standards.

- Automated lease classification tests include the transfer of ownership, purchase option, lease term, present value and unique asset. These are easily configured through the lease book and lease groups.

- Once a lease has been classified, finance teams can automate the lease calculation of present value as well as future lease payment, lease liability amortization, right-of-use asset depreciation and expense schedules.

- The functionality of the asset leasing module also includes the generation of journal entries for the initial recognition and subsequent measurement of the lease liability and right-of-use asset.

Integration

- As a fully integrated module of Dynamics 365 Finance the asset leasing module works seamlessly with your current Dynamics 365 Finance features including your organisation’s chart of accounts, currencies, fixed assets, vendors, journals, data management and number sequences.

- The module allows you to benefit from the standard data management tools to support the import or export of all lease data in Excel formats.

Control

- Through the use of different posting layers available with Dynamics 365 Finance, organisations can accommodate different reporting purposes, such as tax reports.

- Organisations also benefit from audit controls over the integrity of the lease data to ensure that the posted transactions match the calculated amounts of the present value, future payments, and liability amortization.

Business outcomes

- The asset leasing module allows you to benefit from features that help in preparing asset leasing reports, and in particular the preparation of disclosures and notes through streamlined and automated process for classifying. This will help organisations manage, plan and analyse lease processes and aid compliance with the new lease accounting standards.